Simulations of the stock market have been around for decades usually focusing on understanding how stocks work and used in an economics or personal finance class or to teach fractions. I wanted to create a short (1 day) simulation of the famous 1929 Stock Market Crash. The goal of this simulation is to get students to feel the lure of over investing when the stock market grows at a fast, unrealistic rate and then to see how fast they can lose it all when the market drops. I wanted them to feel excited about investing and making money so that they would go all in and then crash when the market lowered.

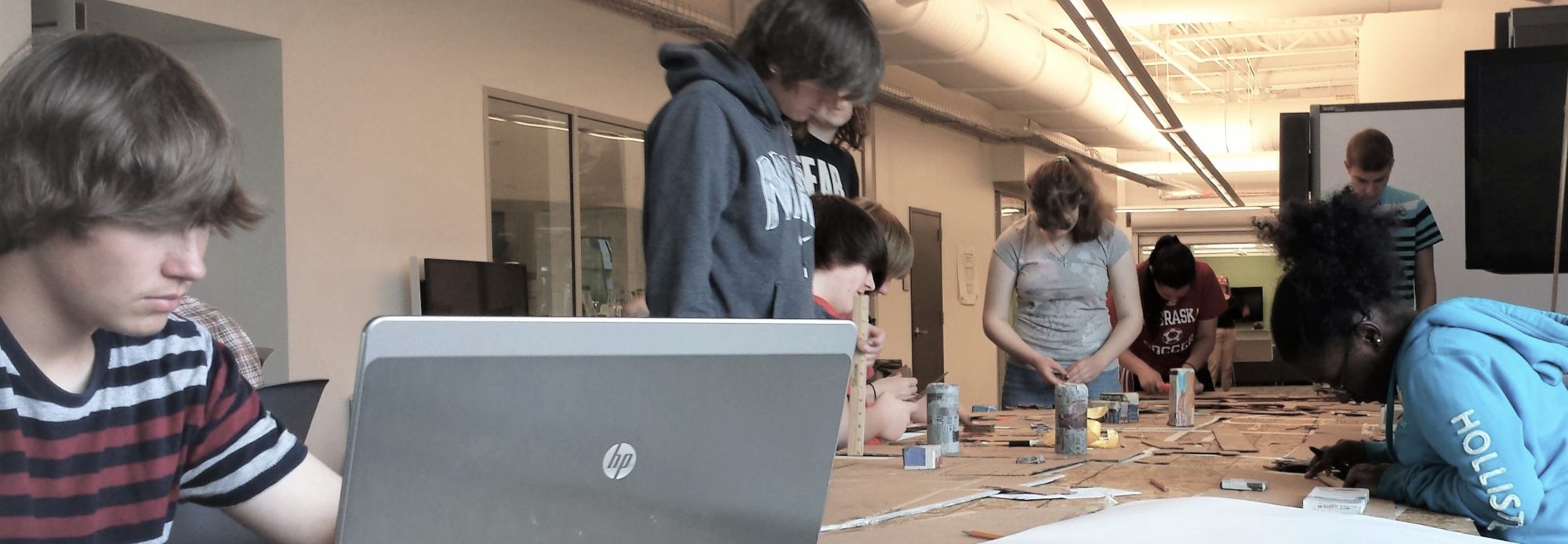

I used this with 10th graders in an American Studies class. There were a couple of bugs with my formulas and designs that I have fixed (you can’t have a good program without some field testing). Sign up on this form for your free student template. Rather than try to explain it all here I made a screencast tutorial for how to use it with your class.

1929 Stock Market Crash Simulation by Mike Kaechele is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Unported License.

A few other hints are to take it slow at first but don’t take too long explaining it. The best way for students to figure it out is to just start playing it. After a few rounds, stop and ask the class who is making the most money and then have students share strategies. All it takes is for a couple of students to figure out that they can make tons of money buying on margin to get the class excited. Be sure to ask how many are still making money after the market crashes.

Afterwards I like to show them the graph that I have linked in the DOW Average Inputs and lead a discussion about the history. The quotes are also priceless and show that economists believed that they had solved the boom/bust cycle of capitalism It should lead to the question of “Why did the stock market crash?” and that is when I turn them loose on research. This simulation could also be a good entry event in PBL.

PS: If you try this simulation drop me a comment and let me know how it went with your students.

Questions? Interested in SEL and PBL Consulting? Connect with me at michaelkaechele.com or @mikekaechele onTwitter.